🔥 Catnip, by the numbers...

Liquidity, Volume, and Trump's Odds

catnip, so far…

Last week, we introduced catnip, a new community-powered interface for trading prediction markets, built on Augur and Balancer.

catnip provides a simpler way to trade real-world outcomes, starting off with one super liquid market on the 2020 U.S. presidential election.

catnip usage has already begun to pick up, and we expect this to accelerate soon, with some big plans coming up to bring in more users.

So I thought it’d be fun today to take a quick look at the numbers so far in terms of liquidity, volume, and usage on catnip.

We’ll save the big question for last: what are the markets predicting for Election Day?

Liquidity

The Balancer pool that powers catnip has ~635k USD worth of liquidity, at the time of writing.

It’s a three-way pool that consists of yTrump and nTrump, the two tokenized election outcomes, and DAI.

Notice the two big spikes in liquidity. These were due to two separate Ethereum addresses each putting in over 200k worth of liquidity. There are 13 liquidity providers in total, with seven putting in at least 10k.

Augur Foundry, the facility for minting and wrapping shares in the market has a TVL of 466k DAI, which comprises almost 70% of Augur’s total open interest.

The main use cases we’ve seen with the Foundry so far are minting shares to provide liquidity on Balancer and minting shares to sell into the pool as an arbitrage play when the price of yTrump and nTrump exceed one DAI.

Trading Volume

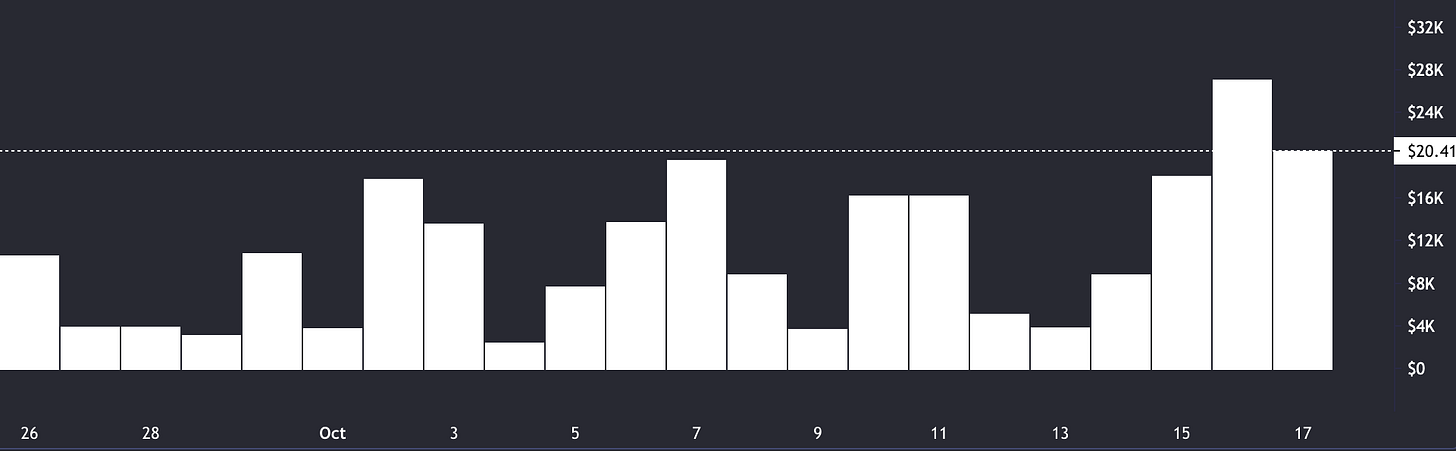

Total swap volume in the pool so far is around 300k. The Balancer UI displays 240k but doesn’t include swaps between outcome tokens, yTrump <=> nTrums, only ones in and out of DAI.

Volume appears to be trending up:

There have been 289 trades in total at the time of writing, ranging from ~1 dollar to ~7.5k DAI.

Slippage

catnip traders can currently buy 1k DAI worth of yTrump at just .5% slippage, 2k DAI worth at 1% slippage, or 10k DAI at 4.8%.

The slippage for nTrump is a bit lower: 1k DAI worth at .46% and 10k DAI at 4.3%.

Users might get even lower slippage by breaking large buys into a set of smaller trades, e.g. a 20k buy into five swaps of 4k each, waiting in between for arbers to rebalance the pool.

Fees

Swaps typically use ~110k in gas, which at current gas costs means around one dollar in transaction fees, though this can jump around from day to day. This is a flat fee, so traders pay around a dollar in gas whether they are swapping 10 DAI or 10 thousand DAI.

The Balancer pool has 1% swap fees and the underlying Augur market has effectively zero settlement fees, or .01% REP fees to be exact.

Election Odds…

Alright, now the fun part…

With just over two weeks out from Election Day, what are the markets telling us?

yTrump is now trading at ~.4 DAI, signaling around 40% odds of Trump winning the election.

This is dramatically higher than 538 which places his odds at 12%, but only slightly higher than other markets like PredictIt and Betfair which have Trump’s odds in the mid to high 30s.

The price of yTrump over the past week, courtesy of Coingecko:

Try Catnip…

If you haven’t tried out catnip yet, feel free to check it out here.

And if you have any questions, feel free to visit our community Discord for AugurDAO, the decentralized collective behind catnip and the Foundry.

This article is not investment or trading advice and apps mentioned here may be risky.