It’s been a crazy couple months for catnip.exchange since we launched in early October.

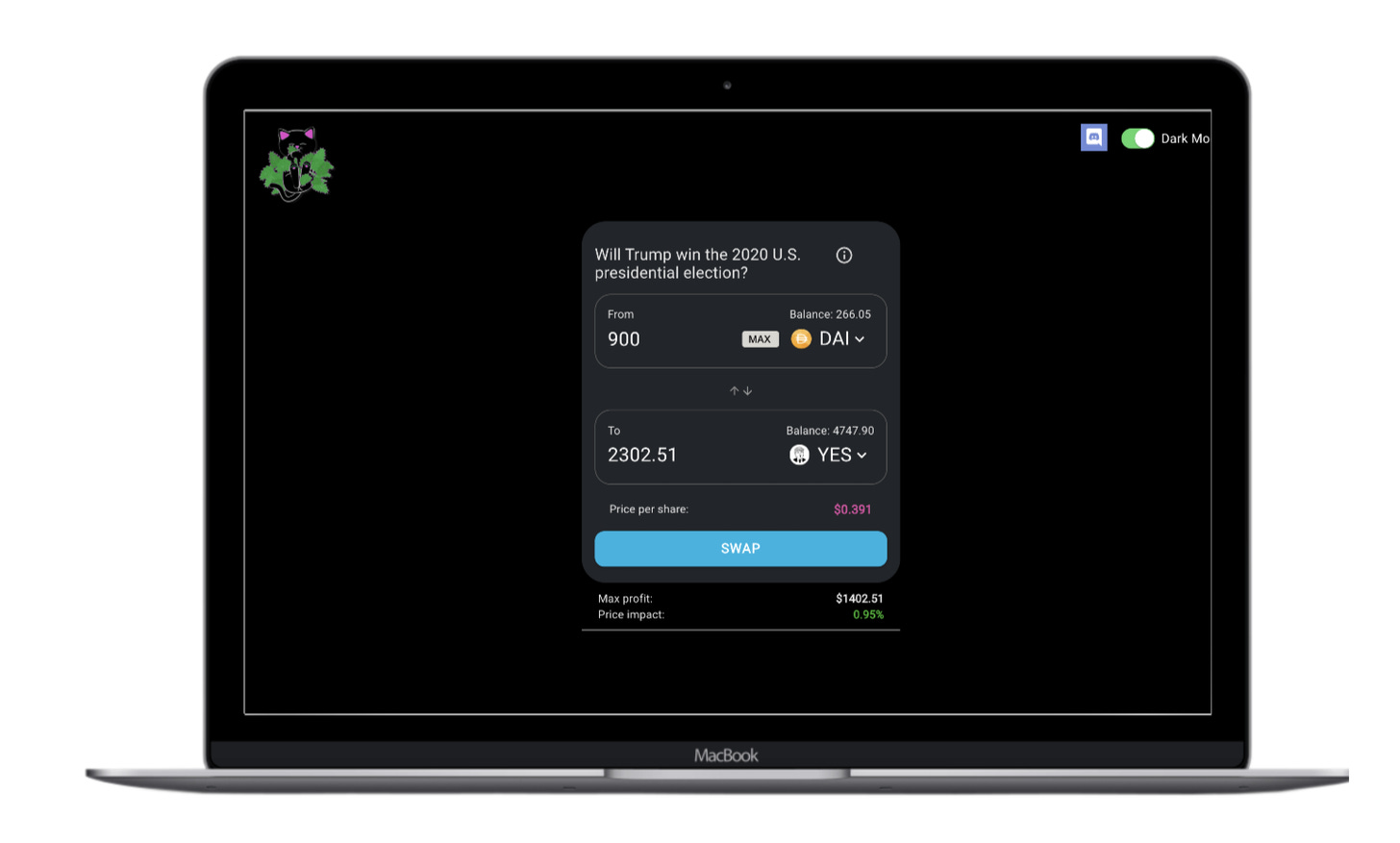

We’ve seen nearly $15M in trading volume on Catnip-Augur outcome tokens, the lion’s share of it on the U.S. presidential election market.

Since the election, we have continued launching new markets, improving Catnip UI, and running experiments like the Maskbook integration we announced yesterday, which lets users trade prediction market shares *directly* on Twitter.

🙏 Support Catnip on Gitcoin Grants

Catnip is live on Gitcoin with just a couple days remaining in Round 8. So far, we have over 40 supporters. As a community-powered, open-source project, we appreciate any contributions and due to the way the matching works, even a small contribution can go a long ways.

👀 Upcoming plans

Today, we’d like to share some of the features, changes, and experiments that we’re most excited for in the coming year as we continue to push the envelope on open prediction markets.

💧 Supercharging Liquidity With Balancer Smart Pools

Smart pools are liquidity pools controlled by smart contracts, putting Balancer’s already high degree of flexibility on steroids. Pool parameters such as swap fees, token composition and token weights can be dynamically changed over time.

These pools will let us improve liquidity for traders and risk management for LPs and enable new types of instruments built around outcome tokens, the base financial primitive that powers prediction markets.

We have a handful of pool constructs we are excited to try out in the coming months. We’ll share more on this soon.

🤝 AMMs <> Order books

Automated Market Makers (AMMs) are a huge win for both trader and liquidity provider UX at this point in Ethereum’s evolution.

But they can be limited.

They may suffer from inefficient liquidity and slippage and do not allow for the risk management that limit orders confer.

Can we lean on AMMs as the core liquidity layer for Catnip while complementing their weak points with limit orders? We think so.

Our starting point is integrating 0x API for early settlement once an outcome is effectively known but prior to market expiration. This will let traders sell presumptive winning shares more easily, rather than waiting until the market settles to redeem a full DAI per share.

Buyers (early settlement providers) will be able to place limit orders via Matcha, and then catnip.exchange as well as other interfaces that uses the 0x API will route orders via both these limit orders and Balancer, as well as any other liquidity sources to find the best price.

😻 Improving Catnip UI

We modeled Catnip UI on the simple Uniswap frontend that has taken the DeFi world by storm.

While preserving this simplicity, we plan to add native prediction market features such as dedicated market discovery, P&L (profit/losses), historical (and eventually real-time) price charts, and social.

We also plan to route orders more efficiently to reduce slippage. Currently, all orders are sent directly to Balancer, but larger buys can often get better prices by minting complete sets of shares and then selling one side into the pool.

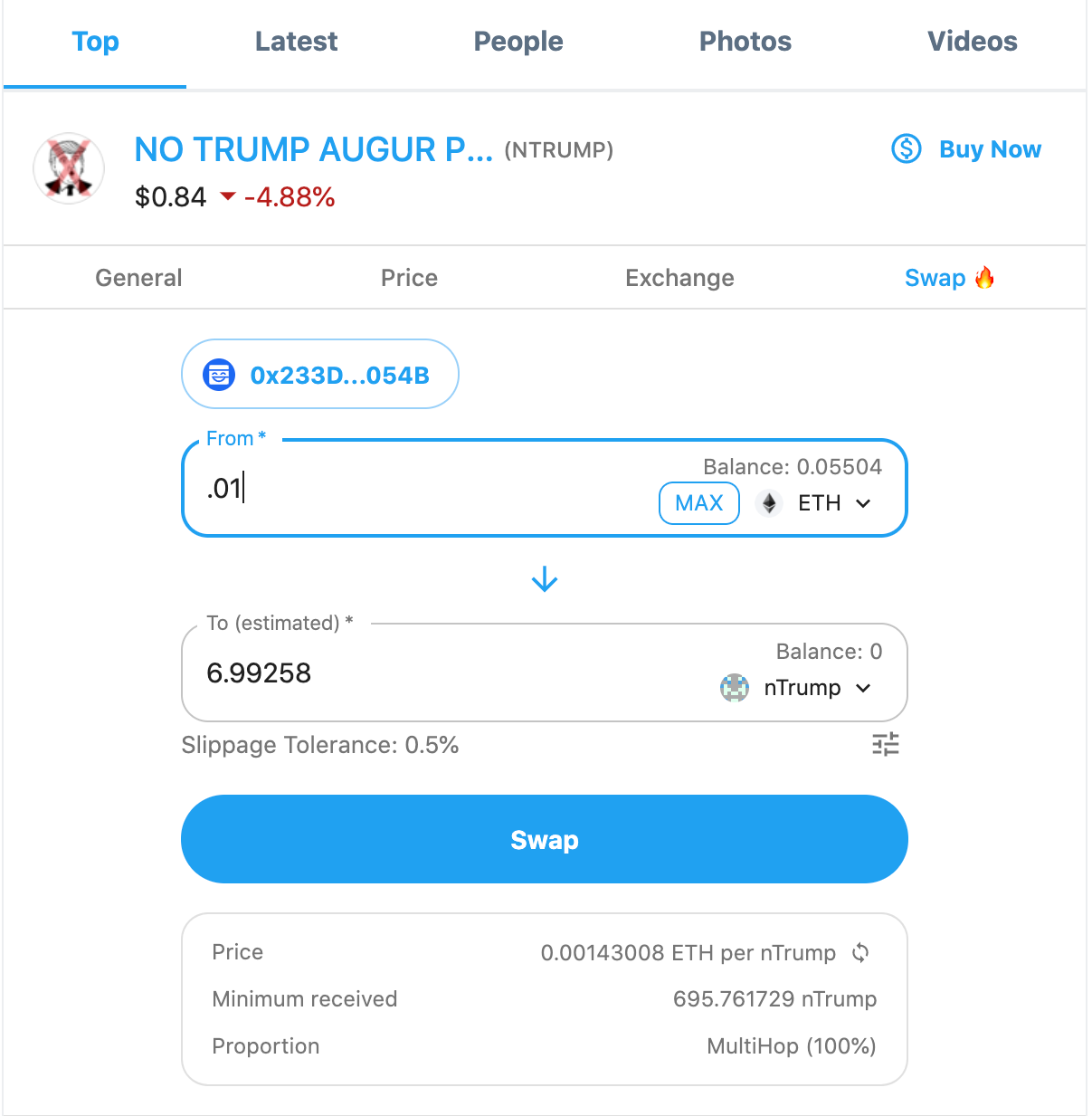

For example, a trader who wants nTrump could mint nTrump, yTrump, and iTrump and then sell the yTrump (and iTrump) for nTrump. Some traders are already doing this manually on foundry.finance, but we plan to hook this straight into Catnip UI.

🌌 Spreading Catnip-Augur Tokens Across the DeFi Universe

Catnip's vision is to build a decentralized outcome token registry and liquidity engine for prediction markets. The catnip.exchange interface is an important first step toward this vision, but we seek to become less reliant on a single UI over time.

This will involve expanding Catnip-Augur tokens into new UIs, aggregators, and liquidity pools. One of Catnip’s biggest assets is composability. Our outcome tokens are ERC20s, so they are compatible with any DeFi application. Our new integration with Maskbook is a taste of things to come on this front.

We do expect that Balancer will remain the flagship liquidity infrastructure for Catnip because of its flexibility as well as its strong community and rapid innovation.

💰 Skin in the Game Social UX

Outcome tokens are financial contracts that pay out on the basis of any verifiable, future state of reality. Catnip-Augur Tokens (CATs) are a special breed of outcome token that are transferrable, censorship resistant, and composable.

These tokens may be used for many things, including:

Betting

Trading

Information surfacing, signaling and market-driven news outlets

Risk hedging/insurance

Bounty creation

ETF-like Baskets that track public figures or real-world trends

Lending, borrowing, and probably other “money verbs” outside of exchange

One use case that we’re super excited to experiment with is skin in the game social discourse.

Using collab.land, we recently created a Discord channel for verified yTrump and nTrump holders. Our next step is to bring skin in the game discourse to the heart of political and crypto conversation: Twitter.

Stay tuned for that…